Financial Planning for Small Business

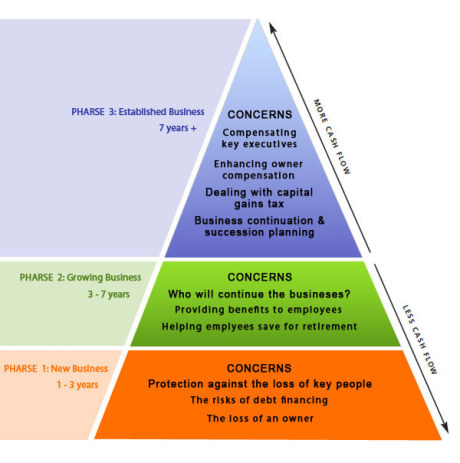

Small business owners have many concerns and needs that extend well beyond the scope of this guide or of most insurance practices. Tax, legal, and accounting needs require help from peer professionals in those fields. Insurance professionals like you should focus on areas for which life insurance, disability income insurance and annuity products can provide the best solutions. Most small businesses have fundamental planning objectives that insurance professionals can help address:

• Protecting the business against the financial hardships of death and disability. Core solutions include: Buy-Sell Planning, for business continuation after the death of a co-owner; Key Person Insurance, to insure against the loss of a key employee; Disability income insurance, for protection of owners and key employees to protect a portion of their earned income; and Multi-Life Guaranteed Standard Issue disability income insurance that allows business owners to offer disability income protection with limited underwriting.

• Recruiting and retaining key employees. Core solutions include: Employer-Sponsored Retirement Plans for base retirement benefits; Executive Bonus as a simple tool for rewarding key personnel; Split Dollar as a specialized technique for structuring a benefit program; Supplemental Executive Retirement Plan (SERP) for a more comprehensive benefit to attract and retain talented executives and key employees. The following pages detail these sales concepts, and also list the resources ECG provides.

Size and scope of the market

• Small firms comprise approximately 98 percent of all U.S. employers and provide jobs to over 40 million people, or 35 percent of the U.S. workforce. Furthermore, new small firms are entering the market all the time'

. • Various studies of the “affluent market,” meanwhile, have found that about one-third of the people in this income category are business owners. Established business owners have incomes and assets about onethird higher than the average for the U.S. population, according to research from LIMRA International.

• Roughly three-fourths of small business owners are in their prime child-rearing and income-producing years and are “peaking” in their need for life insurance

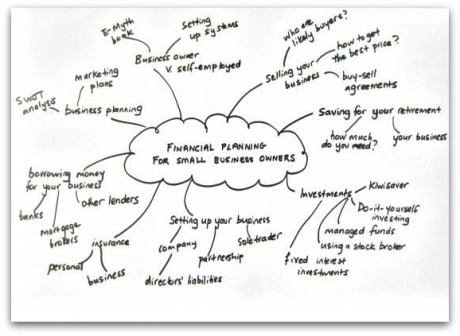

BUSINESS OWNER FINANCIAL PLANNING NEEDS

In addition to managing their complex business operation, which is required to stay profitable, business owners face a number of other planning concerns.

Below are areas of concerns that may be of particular interest to you, the business owner.

Business Concerns:

• Succession Planning: A business owner faces a series of particular problems when planning to sell his or her interest in the business. Careful planning using buy-sell agreements can allow the business owner to successfully make this transition, achieve a profitable sale of the business, manage the risk associated during the transition and reduce any potential income tax liability.

• Key Employee Planning: The death or disability of a key person can have a dramatic impact on the operation of a business. In a small business, it can be devastating. Protecting your company from financial losses with key person coverage has long been recognized as invaluable.

• Executive Benefit Planning: Providing additional benefits for a few select key employees is usually done through non-qualified plans, such as executive bonus and salary continuation arrangements. These are called “non-qualified” plans because they do not meet certain IRS codes and, therefore, have different tax treatment. As such, they do not have to be offered to all employees, as qualified plans do, like group insuranceand pension plans.

Estate Concerns:

• Estate Planning: Business owners have a need for a good estate planning attorney, since most of their assets are usually tied up in their business. Death taxes, probate fees and other estate settlement costs can be a burden if there isn’t sufficient liquidity to meet these expenses.

• Survivorship Needs Planning: Death of a small business owner entails additional consideration if the business is not able to survive the death of the owner. Family protection needs to be considered if the business was the family’s primary source of income.

• Charitable Planning: Many persons make gifts to charity for a variety of reasons. Whatever the reason, U.S. tax law is designed to encourage these gifts. Proper tax planning can leverage the gift for the benefit of the donor and the charitable organization.

Retirement Concerns:

• Planning for Your Retirement: Retirement planning for business owners inevitably includes consideration for what to do with the business. A business owner’s decision to retire requires much more than just setting a retirement date. Succession planning thoughts are inescapable and on every business owner’s mind, whether to sell, transfer or simply close the doors.

• Qualified Retirement Plan: Employer- sponsored qualified pension plans can easily be classified as either defined benefit or defined contributions. A defined benefit plan specifies a guaranteed retirement benefit, but requires an actuary to determine each year’s contribution amount. A defined contribution plan specifies yearly contribution amounts, but does not guarantee a retirement benefit.And, there are a multitude of choices within these two categories. Selecting the right plan for your business requires expert advice.

• Investment Risk Analysis: Reducing risk, while maintaining a desired rate of return, requires spreading investments over a number of asset types. But, there is no single investment strategy to fit every investor. That is why a careful analysis of an individual’s investment goals, time horizon and risk tolerance is critical to building a suitable investment portfolio.

Other Concerns:

• Long-term Care Planning: The need for long-term care is generally defined by an individual’s inability to perform the normal activities of daily living (ADL) such as bathing, dressing, eating, toileting, continence, and moving around. While the need for long-term care can occur at any age, it is typically older individuals who require such care. Business owners can use tax-deductible dollars to pay for long-term care insurance for themselves and/or their key employees.

• Disability Income Planning: When you consider the likelihood that you or one of your key employees may become disabled, there is a clear need to protect both your personal income and the financial well-being of the company. Disability income insurance is a tax-deductible business expense and can be setup for just you, a few select key employees or as a company wide group insurance program.

• Life Insurance Planning: Life insurance plays a number of important roles in the business world, benefiting business owners, employees, and family members. Business owners know that family protection is not the only purpose of life insurance. The loss of a business owner or key employee can seriously damage a small business or even result in the business closing its doors. Advance life insurance planning can help cushion the impact of such events.