Medicare Parts

So what do all these Parts mean, anyway?

Let’s break it down.

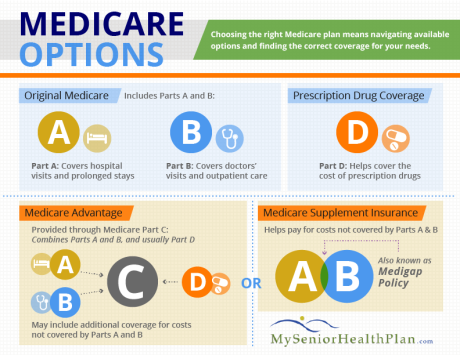

Original Medicare

Original Medicare is the collective name for Medicare Parts A and B.

Part A

Part A is one of the two parts that make up Original

Medicare, and it covers hospital costs. Part A is

available, at no additional cost, to everyone who

qualifies for the Medicare program. Why? Because

you’ve already paid for it! Anyone who has paid

Social Security taxes in the United States pays into

the Medicare program, and the costs of Part A come

out of that money. If you or your spouse has worked

for at least 40 quarters in the U.S., you’re eligible for

Medicare Part A.

In general, Part A covers:

• Hospital care

• Skilled nursing facility care

• Nursing home care

• Hospice

• Home health services

Part B

Medicare Part B, the other part of Original Medicare,

covers services needed to diagnose or treat a medical

condition, illness, or disease. It’s easiest to think about

it as the part that covers your doctor’s visits, although

Part B covers services far beyond simple checkups,

like research, testing, and certain medical equipment.

Medicare Part B also takes care of preventive services

that help you avoid illness or detect it at an early stage

when treatment will work the best.

In general, Part B covers:

• Doctor visits

• Ambulance services

• Durable medical equipment (DME)

• Mental health: inpatient, outpatient, and partial

hospitalization

• Getting a second opinion before surgery

• Limited outpatient prescription drugs

Medicare Part B only covers “medically necessary”

services that have been approved by CMS. Certain

tests, items, or services are covered in all cases; others

vary by your circumstances (see the Appendix). If you

need care that is not considered “medically necessary,”

you may be able to appeal your case to Medicare, so

you should talk to your doctor about further steps.

Part C

Also known as Medicare Advantage, Medicare Part

C is offered by private insurance companies that are

approved by Medicare. It offers the same coverage as

original Medicare, but adds coverage for other services.

These vary widely plan by plan, but they can include:

• Vision

• Hearing

• Dental

• Health and wellness programs

• Prescription drugs

If you’re interested in an all-in-one Medicare Advantage

plan it’s a good idea to talk to one of our licensed

agents about your options. They will include some or

all of these kinds of plans:

Health Maintenance Organization (HMO)

plans

HMOs limit your healthcare options to in-network

providers. Except in an emergency, you can only go to

doctors, other health care providers, or hospitals in

the plan’s network. If you need some particular tests

or care from specialists, you may also need to get a

referral from your primary care provider.

Preferred Provider Organization (PPO) plans

A PPO also limits your provider options, but not as

much. You pay less, sometimes significantly less,

if you use in-network doctors, hospitals, labs, and

other providers. For instance, in-network you may be

responsible for a small copay, while out-of-network you

may need to pay coinsurance, a percentage of your bill

that’s often more than a copay.

Private Fee-for-Service (PFFS) plans

PFFS plans offer wider options. As in Original Medicare,

you can likely go to any provider who agrees to treat

you. However, the amount of the provider’s fee for

which you’re responsible may vary plan to plan.

Special Needs Plans (SNPs)

SNPs are for special groups of people, like those who

have both Medicare and Medicaid, live in a nursing

home, or have certain chronic medical conditions.

HMO Point-of-Service (HMOPOS) plans

These plans are still HMO plans, but they offer broader

options than most. They may allow you to get some

services out-of-network for a higher copayment or

coinsurance.

Medicare Supplement Highlights:

■ Your Medicare Supplement policy enables you to see any doctor or provider who accepts Medicare.

■ Your Medicare Supplement policy covers your health care needs anywhere in the country.

■ Benefits can be paid to you, your doctor or your hospital.

■ Your policy has no Pre-Existing Condition* waiting period. Your coverage begins immediately.

■ Your policy is Guaranteed Renewable for life. As long as you pay your premiums on time.**

■ 30-Day Free Look If you are not totally satisfied, you may return your policy within the first 30 days for a full refund of the premiums you paid.

Exclusions and Limitations: Your Medicare Supplement policy will not pay for:

■ any medical expenses incurred before the effective date of your policy

■ any expenses paid for by Medicare

■ any services for expenses that are not Medicare-approved expenses

How to Pick a Medicare Policy

When you’re picking a Medicare policy, it helps to start

by making a list.

• Write out your current and expected healthcare

needs.

• Write out your habits. For instance, do you travel?

Are you particularly active? Do you smoke?

• Write out your income, and your potential budget

for out-of-pocket expenses.

• Consider your location. Which hospitals and

doctors are most convenient to you?

• Ask your current healthcare providers what type

of coverage they accept. Do you want to keep your

current providers?

As you begin to make your choices, take each of these

factors into account. Then, list in hand, call a licensed

agent. We have a lot of experience in

guiding you through the things you need to think about

in order to select the kind of policy that works for you.

Picking a Medicare policy may seem complicated, but

it’s easier than it sounds. Check out our infographic to

the right to see the steps to take when deciding on a

Medicare policy.

Privacy Notice: By clicking the send button, you agree that we may contact you at the listed phone number to verify your interest in receiving quotes. Receiving quotes through our website is always free and you are under no obligation to purchase any goods or services as a result of this request. Your information will not be passed, and will be kept private. By using this form you agree to the terms of our private policy as so stated.