What Is Short-Term Care Insurance

The typical Short-Term Care insurance (STCi) policy provides coverage for 1 year or less. For many people, this is a very appropriate and affordable amount of coverage. It is true that some long-term care claims last for many years,however, almost half (49%) of long-term care insurance claims LAST ONE YEAR OR LESS.

The majority of policies have a 0-day deductible (Elimination Period) and a full year of benefits. Simply, that means the policy pays on the very first day one qualifies for benefits. Most traditional long-term care insurance policies (about 94%) are sold with a 90-Day Deductible that must be met before benefits are paid.

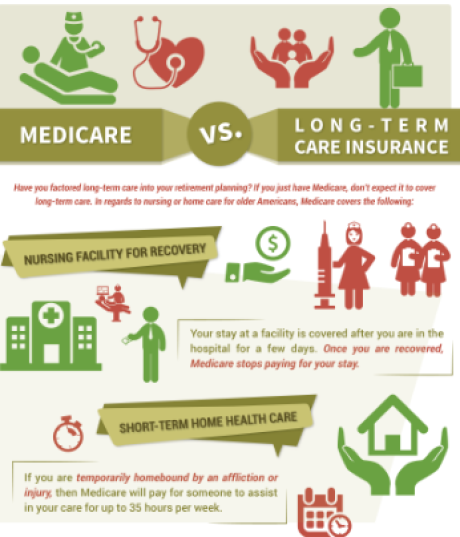

It is important to know that these policies can pay in addition to Medicare -- something a traditional Long-Term Care Insurance policy is prohibited from doing.

Most Short-Term Care applications have 7-to-10 health questions. If you can answer "NO" to all the questions, you are 95% through the health underwriting process. However, there are policies that have ONLY 2 "YES" "NO" QUESTIONS and can be ideal for people with existing health problems.

Who Should Consider A Short-Term Care Policy?

- You (or a spouse) were DECLINED for traditional LTC Insurance.

- You want a LESS EXPENSIVE option (than traditional long-term care insurance).

- You WAITED TOO LONG to buy long-term care insurance (cost is now too high!).

- You are AGE 80 OR OLDER.

- You are a SINGLE WOMAN (rates for Short-Term Care policies are NOT GENDER-BASED as they are with traditional long-term care insurance).

- You have a long term care insurance policy and you want to cover the Elimination Period.

The typical person buying short-term care insurance is between the ages of 65 and 74 and has a net worth of less than $500,000.

How Much Does Short-Term Care Insurance Cost?

- Typical premium at age 65 -- $105 monthly .

- Typical premium at age 70 -- $141 monthly option.

Medico Short Term Recovery Care Insurance

- Issue Age 18-79

- Elimination Period Choose 0, 15 or 30 days

- Daily Benefit Amount Options $100 - $300 in $10 increments Pays actual charge up to the selected daily benefit amount

- Lifetime Maximum Benefit Period Options 120, 240 or 360 days

- One-Time Restoration of Lifetime Maximum Benefit Period

- Bed Reservation Benefit

- Save 10% with a Household Discount

WHAT CAN POLICIES COVER?

Short-term care insurance policies can vary in terms of what they cover as well as coverage limits. But, in general, these policies

will cover:

Home Health Care – YES

Assisted Living Facility Costs – YES

Skilled Nursing Home Stays – YES

Adult Day Care/Hospice Care – YES