Generally, your personal auto insurance policy wasn’t designed to provide

you with coverage when you are working as a rideshare driver with companies like Uber. And,

rideshare companies' full commercial liability coverage doesn’t apply until you accept a ride. With Farmers Rideshare, you can avoid a potential gap in coverage by extending your personal auto

insurance coverage when you are logged in and waiting to be matched with your next rider.

What gap? Doesn’t the rideshare company’s insurance policy cover me when I’m working?

When you log in to the rideshare company’s app, you may only be covered

by the rideshare company’s limited liability coverage until you accept a ride and their full commercial liability coverage applies. While you are waiting to be matched with your next rider,

their policy generally only provides limited liability coverage* for medical expenses and damage you cause to others if an accident is your fault. Damage to you or your car are not typically covered

by this policy. You could be faced with a serious coverage gap that would require you to pay for damages out of your own pocket.

RideSharing Coverage Fills in the Gap – and Then Some

Extend your personal auto policy: With RideSharing Coverage, you get

nearly the same coverage during applicable ridesharing activities as you do any other time you drive. Most of the coverage and options you selected for your Safeco auto policy extend to your

RideSharing Coverage.

Cover your ridesharing gap for mere cents a day

Identify which vehicle you use for ridesharing: Your RideSharing Coverage will only apply to the vehicle specified on your policy. If you have other vehicles insured, the coverage will not apply to

them unless you purchase coverage for each one.

Rideshare coverage ends when you accept a ride. The rideshare company’s full commercial liability coverage applies until that ride exits your car. Rideshare once again applies until you accept your next ride.

Uber has been much in the news lately, mostly because of alleged frat-rat antics in the executive suite. But less noted is the growing risk consumers face when they decide to pick up a few extra bucks by turning their personal car into a rideshare vehicle.

Uber, Lyft, and the other ride networks wax eloquent about the virtues of entrepreneurship, American ingenuity, and so forth but tend not to dwell on the insurance issue in their promotional blather. Insurance companies are beginning to fill the gap, issuing warnings to their customers and, in some cases, offering special coverage for rideshare drivers.

“If you are driving for a rideshare company with a personal auto insurance policy, you might be taking a huge risk,” said Othello Powell, Geico director of commercial lines. “Most personal auto policies were never designed to protect you or your vehicle for commercial purposes.”

A typical personal auto policy contains coverage gaps and limitations for ridesharing and package delivery. If an accident does happen with drivers’ personal auto policies, they have to provide their insurance carriers with specific details, including the phase of the ride they were in, said Geico in a statement.

Different phases

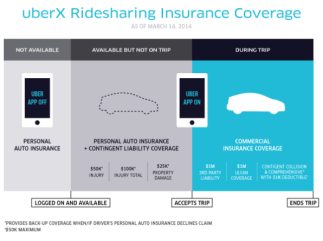

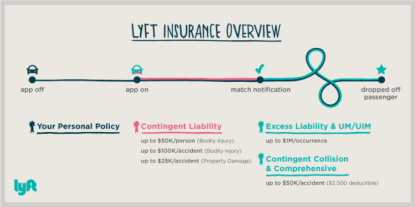

As many companies see it, a rideshare driver goes through many phases in a typical hour:

- leaving home with the network app off;

- cruising for passengers with the app on;

- driving to meet a passenger or pick up a passenger;

- transporting the passenger or package;

- returning to cruising with the app on; and

- finally, turning the app off and driving home or to some other personal destination.

Most personal policies can be counted on to cover the first and last phases -- when the driver is transporting himself and is not yet cruising for passengers. All of the others are questionable, and the driver may not be covered in the event of an accident during the other phases.

This could spell lifelong financial disaster if someone is seriously hurt or killed in an accident.

For example: Was the app on or off? Was the vehicle carrying any passengers or packages? Depending on the answers, drivers may not have the coverage they thought they had, Geico said.

Supplemental coverage

The easiest, though perhaps not the cleanest, solution is to purchase coverage from Uber, Lyft, or whatever. Uber offers a policy that provides $1 million liability coverage from the time a driver picks up a passenger and the time the passenger gets out. Lyft has similar plans.

As with any insurance, rates vary from one state to another and depend on your driving record, where you live, and other factors, so to comparison-shop effectively, you'll need to visit several company sites and gather quotes from each.

It's important to note that these commercial policies are supplemental -- you must still have your own personal policy to cover you when you are not driving commercially.

Additional protection

If you're thinking of becoming a rideshare driver, it's also worth setting up an LLC to provide an additional layer of protection. An LLC -- limited liability company -- provides corporation-level liability protection when properly set up.

Instead of driving under your own name, Jillian Doe, you would use your LLC's name -- Jillian Doe LLC, Doe Global Transport, or whatever -- and your car, insurance policies, and other business essentials would all be in the LLC's name. If someone wants to sue you, they would have to sue the LLC, not you personally.

Having your own LLC can also be a big help at tax time, as it can help you keep your business and personal income and expenses separate, giving you a more realistic picture of just how profitable -- or unprofitable -- your driving sideline really is.

There are numerous websites that have more complete explanations. You should also talk to your tax advisor and attorney for advice and counsel.

Ride share coverage for Uber & Lyft drivers. Submit quote below. (Coverage in & out of drive mode)

NOTE: Need previous personal declaration page, Uber/Lyft coverage declaration page, and VIN number