- Complete our application, disclosure and authorization forms and provide us with all necessary documentation.

- When these forms and documents have been received, our work begins.

- Our staff will immediately review your application, making sure all documents have been completed properly. Please remember to submit a copy of the life insurance policy.

- Next, your life insurance and medical status is verified by acquiring all of the necessary documentation from your insurance company as well as your doctor.

- Once the proper information is verified, your case file is then reviewed by an insurance specialist and professional medical expert.

- Based upon these reviews, your file is evaluated and negotiations begin with multiple providers.

- We will negotiate the absolute highest settlement amount available we can for your policy. Please review our negotiation process for more detailed information.

- We then relay the highest offers to the applicant and he/she decides whether or not to sell the policy.

- If the offer is accepted, then legal closing documentation is drafted and mailed overnight to the policy owner (applicant), which includes: a purchase and sale agreement, life insurance policy change forms, beneficiary waivers, etc… These documents must be signed, witnessed and notarized in order for the transaction to be completed.

- Upon the return of these closing documents, the policy change forms are then submitted to your life insurance company to transfer the rights of the policy to the provider, who purchased your policy.

- Payment to the provider is completed via bank check or wire, within twenty four (24) to seventy two (72) hours following the verification of the life insurance policy transfer of ownership and beneficiary rights to the policy. Please note that this time period may differ by state, depending on existing state law and provider agreement in non-regulated states.

- Policy owner has the right to change his of her mind from the date funds are received (rescission period). This period varies from state to state and ranges from seven (7) to potentially thirty (30) days. Please check your Life Settlement Purchase & Sale Agreement and/or state regulations for the applicable time period. [Note: fifteen (15) calendar days is the most commonly used timetable].

Evaluating a Life Settlement and the potential value it can provide can be an important part of retirement planning.

The reasons for seeking a Life Settlement can be as varied as individuals' retirement plans or paying down debt. Common reasons for seeking a Life Settlement include:

- The Life Insurance payments are burdensome

- Your policy does not perform as expected

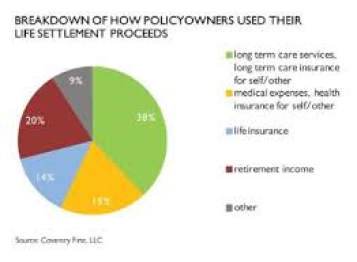

- You require additional funds for medical expenses

- A need to pay for a long-term care policy

- You wish to upgrade your current life insurance policy

- Divorce makes the policy unwanted

- Your children are grown and no longer require the protection

- You wish to use the money now for a vacation home or travel

- A business is closed

- You wish to give the money to a charity

- You no longer have a need for Life Insurance due to:

- A diminished need for the safety net a life insurance policy provides

- Being over-insured

- Tax law changes which may have reduced your need to subsidize estate taxes

- Other circumstances

Your form message has been successfully sent.

You have entered the following data:

Interested in Life Settlements

Please correct your input in the following fields:

Error while sending the form. Please try again later.